Get To Know Us

We have loan officers in your community that thrive on helping you find the right mortgage to fit your needs.

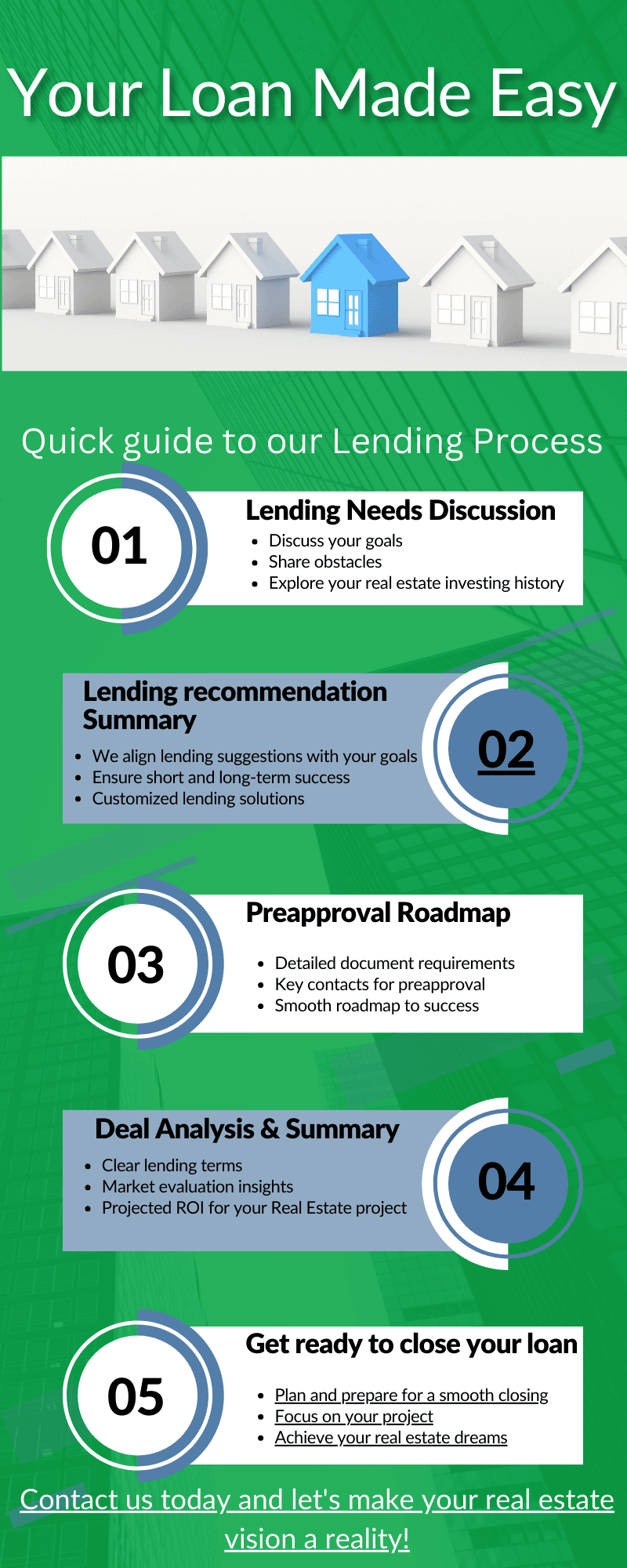

Loan Process

Step 1: Lending Needs Discussion:

The first step in securing a loan is a consultation with one of our lending experts. Whether you're purchasing a primary residence, an investment property, or planning a Fix & Flip or rental, we’ll help you find the best financing option to fit your goals.

By answering a few simple questions, we’ll assess your needs and present the loan solutions that align with your objectives.

Preapproval Roadmap

We always recommend getting preapproved first.

A preapproval shows sellers that you are serious and prepared, giving you a competitive edge. We understand that finding the right property takes time and effort—our goal is to make financing fast and hassle-free.

Getting preapproved is quick and simple with our lending experts. After completing a short application, we’ll provide a detailed outline of terms and next steps so you can move forward with confidence. Our efficient online portal ensures a smooth and speedy closing process.

Lending Recommendation Summary

Our priority is to align our recommendations with your financial goals. We act as your trusted advisor, providing the best loan solutions for your real estate ownership needs—whether you're purchasing, refinancing, or investing.

Our goal is to build a long-term relationship, making you a customer for life by delivering expert guidance and exceptional service.

Deal Analysis & Summary

With so many financing options available, it's essential to have a clear and in-depth understanding of your loan choices.

We provide a detailed analysis of the best loan solutions tailored to your investment strategy, ensuring you make informed and confident decisions for your real estate financing needs.